Seniors Should Watch Out for Pyramid Schemes

Older adults seeking ways to supplement their income or stay active after retirement are increasingly being targeted by pyramid schemes. The Gerontological Society of America calls elder financial exploitation “the crime of the 21st century,” costing older adults almost $3 billion every year. Families, seniors, and financial institutions need to understand how these scams work and how to recognize them.

Scammers recognize that Americans are living longer and may need employment to supplement Social Security or want to earn extra money during retirement. These con artists concoct an endless variety of phony work-at-home schemes and investment “opportunities” specifically designed to exploit seniors.

According to Investor.gov, a consumer portal from the U.S. Securities and Exchange Commission (SEC), seniors with a nest egg or those wishing to earn money after retirement are particularly vulnerable to fraudsters promoting pyramid schemes. These schemes are increasingly advertised through social media and internet advertising.

How pyramid schemes disguise themselves

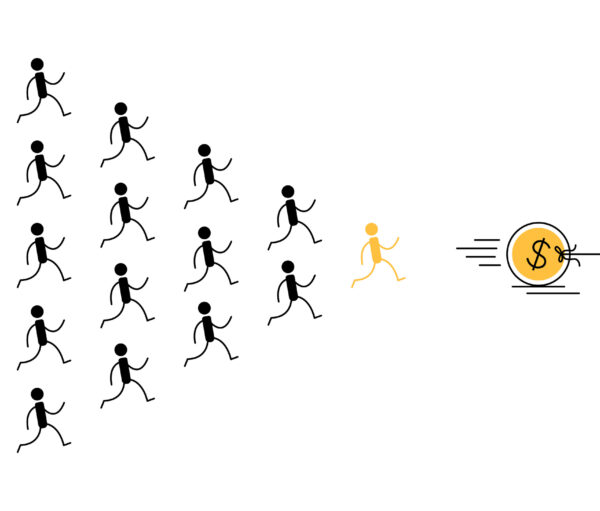

Pyramid schemes masquerade as legal multi-level marketing programs, in which participants are supposedly paid not only for products they sell but also for products sold by distributors in their “downline.” Promoters go to great lengths to make these programs look like legitimate businesses, but the reality is quite different.

The fraudsters use money paid by new recruits to pay off earlier-stage investors, who are usually recruits themselves. At some point, the schemes grow too large, the promoter cannot raise enough money from new investors to pay earlier investors, and people lose their money—often their life savings.

When fraudsters attempt to make money solely by recruiting new participants into a program, that is a pyramid scheme, and there is only one possible mathematical result: collapse. The SEC explains the impossibility this way: Imagine if one participant must find six other participants, who in turn must find six new recruits each. In only 11 layers of the “downline,” you would need more participants than the entire population of the United States to maintain the scheme.

If you are an older adult, or you have senior friends, relatives, or clients who are seeking moneymaking opportunities, watch for these hallmarks of a pyramid scheme:

Emphasis on recruiting. If a program focuses solely on recruiting others to join for a fee, it is likely a pyramid scheme. Be skeptical if you will receive more compensation for recruiting others than for product sales.

No genuine product or service is sold. Exercise caution if what is being sold as part of the business is hard to value, like so-called tech services or cryptocurrency.

Promises of high returns in a short time. Be skeptical of promises of fast cash—it could mean that commissions are being paid out of money from new recruits rather than revenue generated by product sales.

Easy money or passive income. There is no such thing as a free lunch. If you are offered compensation in exchange for doing little work, such as making payments, recruiting others, or placing online advertisements on obscure websites, you may be part of a pyramid scheme.

No demonstrated revenue from retail sales. Ask to see documents, such as financial statements audited by a certified public accountant (CPA), showing that the company generates revenue from selling its products or services to people outside the program. As a general rule, legal multi-level marketing companies derive revenue primarily from selling products, not from recruiting members.

Complex commission structure. Be concerned unless commissions are based on products or services that you or your recruits sell to people outside the program. If you do not understand how you will be compensated, be cautious.

Before investing in any opportunity, talk to your financial adviser about what you’re considering. Research the company thoroughly and ask tough questions about how the business actually generates revenue. Remember that if an opportunity sounds too good to be true, it almost certainly is.

By staying informed and skeptical, older adults and their families can protect hard-earned savings from these predatory schemes and the financial devastation they leave behind.

Source: IlluminAge with information from the U.S. Securities and Exchange Commission’s Office of Investor Education and Advocacy